Gujarat Toolroom Ltd., a penny stock specializing in mining, precision tools, and renewable energy, witnessed a 5% upper circuit. The surge came after the company announced its Board of Directors is meeting on January 6, 2025, to consider issuing bonus shares in a 5:1 ratio, signaling potential value creation for its shareholders.

Business Highlights

Precision Engineering and Tools:

Gujarat Toolroom Ltd. has established itself as a leader in precision tools and engineering solutions. With its expertise in designing molds and manufacturing advanced tools, The Company is also enhancing its technical capabilities with Schober AG of Switzerland’s partnership.

Wind Energy Solutions:

Financials

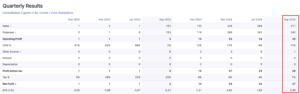

Gujarat Toolroom reported good financial growth in its latest quarterly result with its operational efficiency and successful market penetration.

| Metric | Q2 FY24 (₹) | Q2 FY25 (₹) | Growth (%) |

|---|---|---|---|

| Net Sales | 157 crore | 271 crore | 73% |

| Net Profit | 2 crore | 27 crore | 1,250% |

The company’s impressive profit growth showcases its ability to capitalize on strong market demand and operational scalability.

Shareholding Pattern

As of December 2024, the company’s shareholding is dominated mostly by Retail and Foreign Institutional Investors (FIIs):

| Stakeholders | Percentage (%) |

|---|---|

| Promoters | 0% |

| Foreign Institutional Investors | 30.99 |

| Domestic Institutional Investors | 0.07 |

| Retail Investors | 68.94 |

What Makes Gujarat Toolroom Stand Out?

- The company’s operations span mining, precision tools, and renewable energy, ensuring strength against market volatility.

- Its wind energy products are designed to cater international markets, including India, China, and Brazil, enhancing its export capabilities and global reputation.

- Collaborations with Schober AG of Switzerland enable Gujarat Toolroom to leverage advanced technology for precision engineering and mold-making.

Industry Outlook

Growth Opportunities:

Gujarat Toolroom’s business portfolio, particularly its wind energy solutions, is compatible with the growing focus on renewable energy around the world and India. The company is well-positioned in industries including automotive and aerospace with its precision tools business.

Potential Challenges:

- Market volatility in penny stocks may pose risks for short-term investors.

- The stock may be at risk of speculative trading with its dependence on retail investors.

Gujarat Toolroom Ltd. has gained attention due to the announcement of a 5:1 bonus share issuance, which highlights the company’s impressive financial results and investor-friendly efforts. The company is positioned nicely for sustainable growth, combined with strong business diversification and a worldwide position. which makes it an interesting stock to follow.

Disclaimer:

This analysis/information is for educational purposes only. It’s not a financial advice. Please consult with your financial advisor before making any trading/investing decision.