Kalpataru Projects International Ltd is getting the attention of investors with its impressive order book, of ₹60,631 crore, nearly 3X of its market cap. Known for executing large-scale infrastructure projects, the company’s global operations and recent financial performance have made it more appealing to investors.

What Sets Kalpataru Apart:

With a market cap of ₹22,064.67 crore, Kalpataru Projects is a leader in engineering, procurement, and construction (EPC), delivering projects in power transmission, railways, oil and gas pipelines, and civil construction. Operating in over 70 countries, the company has positioned itself as a major player in global infrastructure development, focusing on providing integrated solutions such as design, manufacturing, and commissioning.

- Executed large-scale projects in diverse sectors like urban development, oil & gas, and transportation.

- Known for timely delivery and innovative project management solutions.

Investors eye this small-cap infra leader with a ₹60,631 Cr order book—nearly 3X its ₹22,065 Cr market cap! 📈#StockMarket #KalpataruProjects #Infrastructure #growthstocks #investing #investingtips

— Findose (@findose_) January 1, 2025

Order Book Strength:

As of September 2024, Kalpataru’s order book stands at a record ₹60,631 crore, driven by:

- ₹11,865 crore in new orders, including a recently announced ₹835 crore deal.

- 90% of orders coming from Transmission & Distribution (T&D) and Buildings & Factories (B&F).

- An L1 position for additional orders worth ₹7,000 crore, with over 75% in the domestic T&D sector.

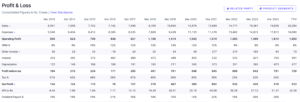

Financial Performance:

Kalpataru Projects has shown consistent growth in revenue and profit, The company maintained its Profit Before Tax (PBT) guidance of 4.5-5%, despite a 5% revenue growth in the first half of FY25.

| Metric | Q2 FY24 (₹) | Q2 FY25 (₹) | Growth (%) |

|---|---|---|---|

| Net Sales | 4,518 crore | 4,930 crore | 9% |

| Net Profit | 90 crore | 126 crore | 40% |

Also Read – Ashish Kacholia’s Stocks Delivered Up to 334% Returns in 2024

Management Insights and Strategy:

- Revenue Guidance: The company remains confident about meeting its targets, despite a high ask rate.

- Domestic Projects: A significant portion of new orders aligns with India’s growing infrastructure demand, particularly in Transmission & Distribution.

- Global Expansion: Continued efforts to penetrate international markets further strengthen its diversified portfolio.

- Power Transmission & Distribution: Key revenue driver, accounting for a majority of the order book.

- Buildings & Factories (B&F): Growth fueled by industrial and commercial projects.

- Railways and Oil Pipelines: Significant contributions to the company’s global reputation.

Future Growth:

The company’s management remains optimistic about its growth prospect, supported by:

- Order Pipeline: Ongoing execution of ₹60,631 crore worth of projects.

- Margins: Efficiency improvements in project delivery and cost management.

- Domestic Demand: Rising infrastructure investments in India, particularly in power and urban development.

Kalpataru Projects International Ltd is a small-cap infrastructure leader, supported by a strong order book, consistent financial performance, and a clear growth strategy. Its ability to secure and execute large-scale projects domestically and internationally keeps it on the radar of investors seeking long-term growth opportunities.