Jubilant Ingrevia Limited, a small-cap leader in life science products, surged by 3.07% after acquiring a 6.67% stake, in Forum Aviation Private Limited (FAPL) to diversify its portfolio. Post-transaction, Jubilant Infrastructure will hold 15.79% of the aviation firm. The deal aligns with Jubilant Ingrevia’s long-term plan of scaling its footprint across different industries, including specialty chemicals, nutrition, and aviation.

Recent Developments:

- Agrochemical Partnership – Jubilant signed a five-year agreement with a global agro innovator to produce a key intermediate, opening new revenue streams and strengthening its market position in agriculture.

- Digital Transformation – The company’s Bharuch facility received global recognition from the World Economic Forum, being named a Global Manufacturing Lighthouse for its groundbreaking digital advancements and operational efficiency improvements.

🚀 Jubilant Ingreviais is acquiring a 6.67% stake in Forum Aviation. Big moves ahead with ₹600-800 Cr annual CAPEX plans targeting specialty chemicals, nutrition & aviation.

Rekha Jhunjhunwala also holds a 2.97% stake.#StockMarket #Investing #JubilantIngrevia #GrowthStocks— Findose (@findose_) December 31, 2024

CAPEX Plans and Future Growth:

Jubilant Ingrevia Limited has laid out robust capital expenditure (CAPEX) plans for the next three years, with an annual investment of ₹600-800 crore targeting:

- Specialty Chemicals: Advanced intermediates and sustainable solutions.

- Nutrition and Health Solutions: Food-grade and cosmetic-grade products.

The company remains committed to its “Pinnacle 345” vision, aiming to 3X its revenue and 4X its EBITDA in the next 5 years.

Financials:

Jubilant Ingrevia’s financial results in Q2 FY25 show steady growth:

- Revenue: ₹1,045 crore (+2.45% YoY)

- Net Profit: ₹59 crore (+3.51% YoY)

- Return on Capital Employed (ROCE): 9.97%

- Return on Equity (ROE): 6.93%

- Debt-to-Equity Ratio: 0.26x

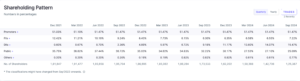

Shareholding Pattern:

| Stakeholders | Percentage (%) |

|---|---|

| Promoters | 51.47 |

| Foreign Institutional Investors | 7.22 |

| Domestic Institutional Investors | 15.47 |

| Public | 25.09 |

Rekha Jhunjhunwala also holds a 2.97% stake, reflecting confidence in Jubilant’s growth trajectory.

Vision for FY25:

- Customer-Centric Growth: Enhancing client relationships to drive margin improvements.

- Operational Efficiency: Focus on reducing costs and optimizing production capabilities.

- Green Initiatives: Expansion into sustainable solutions, including low-carbon products and processes.

Also Read: – Goldman Sachs: Buying These 7 Stocks Continuously

Challenges and Opportunities:

Key Challenges

- Rising input costs in specialty chemicals.

- Increasing competition in the aviation and chemical sectors.

- Ensuring on-time execution of CAPEX projects.

Emerging Opportunities

- Growing demand for customized solutions in pharmaceuticals and nutrition.

- Increased emphasis on sustainability across industries.

- Expansion into global markets through partnerships and innovations.

Jubilant Ingrevia’s acquisition of Forum I Aviation, with its CAPEX plans and industry-first initiatives, shows its commitment to innovation and growth. With steady financial performance and diversified investments, Jubilant could reach new heights in the future.

Disclaimer:

This analysis/information is for educational purposes only. It’s not a financial advice. Please consult with your financial advisor before making any trading/investing decision.